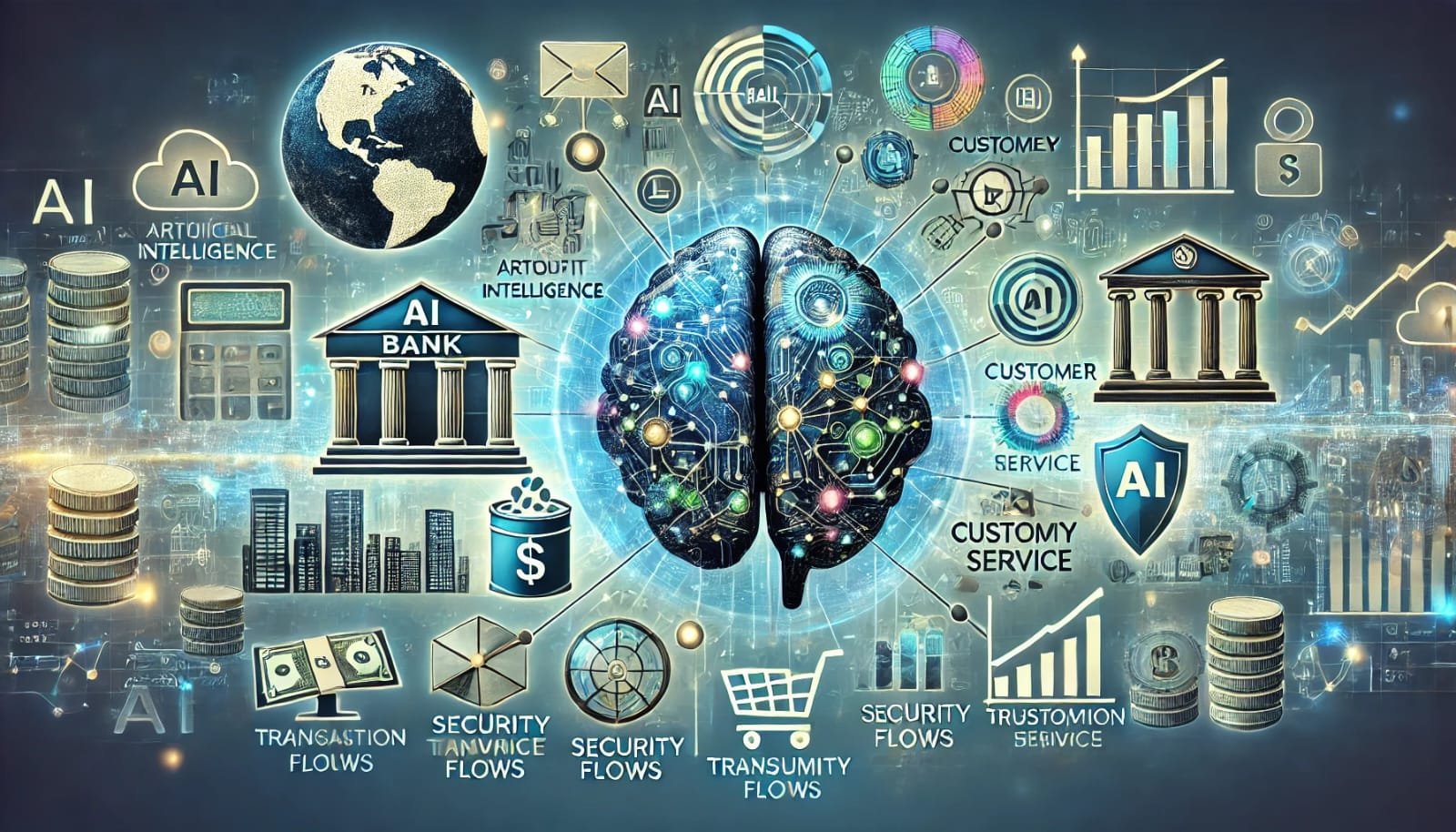

Artificial intelligence (AI) is poised to bring about a profound transformation in the global banking sector. According to a Citi Group report, AI has the potential to boost the banking sector’s profit pool by $170 billion, representing a 9 percent increase, by 2028.

This projected growth would raise the sector’s profits from approximately $1.7 trillion to about $2 trillion.

Such a significant increase underscores the transformative potential of AI in enhancing productivity, operational efficiency, and profitability in banking.

AI’s Impact on Banking Profitability

The Citi TTS Client Survey indicates that 93 percent of financial institution respondents believe AI adoption could significantly enhance profitability over the next five years.

This optimism is driven by anticipated productivity gains as AI technologies streamline operations, reduce costs, and improve decision-making processes.

The Role of Gen AI in Banking

David Griffiths, chief technology officer at Citi, emphasized the rapid adoption and substantial impact of Gen AI across various industries. He noted,

“The pace of adoption and impact of Gen AI across industries has been astounding as it becomes clear that it has the potential to revolutionize the banking industry and improve profitability.”

This statement reflects the growing consensus that AI can fundamentally change how banks operate, offering new avenues for innovation and efficiency.

Transforming Banking Operations

The report by Citi highlights AI’s impending impact on the financial sector, promising to revamp existing operations, bolster security measures, and reshape the global intellectual property landscape.

This transformation heralds a new era of efficiency and innovation in banking, driven by the power of AI.

Enhancing Security Measures

One of the critical areas where AI can make a significant difference is in enhancing security measures. AI-generated insights can help prevent real-time payment scams such as Authorized Push Payment (APP) fraud.

In the United Kingdom, APP fraud accounts for 40 percent of UK bank fraud losses. Estimates predict that APP fraud could cost $5.25 billion in the US, the UK, and India alone by 2026.

By leveraging AI to analyze transaction patterns and detect anomalies, banks can significantly reduce the incidence of fraud and protect their customers’ assets.

AI Regulation in Finance

As AI becomes more integral to the financial sector, regulation becomes increasingly important to ensure its ethical and responsible use.

The European Union, China, and Singapore are early movers in AI regulation in finance, while the USA is taking a more cautious approach.

Regulatory Approaches in Different Regions

European Union: The EU has been proactive in regulating AI, aiming to balance innovation with ethical considerations.

The proposed AI Act sets out comprehensive rules for the development and deployment of AI technologies, focusing on transparency, accountability, and risk management.

China: China has implemented stringent regulations to oversee AI development, emphasizing security, privacy, and ethical standards.

The government’s approach ensures that AI technologies align with national priorities and societal values.

Singapore: Singapore’s regulatory framework for AI in finance is designed to foster innovation while ensuring robust risk management and ethical standards.

The Monetary Authority of Singapore (MAS) has introduced guidelines to promote the responsible use of AI in the financial sector.

India’s Approach to AI Regulation

India has maintained a middle path in regulating AI. Initially, the Minister of Electronics and Information Technology (MeitY) in April 2023 spoke about not considering regulating AI.

However, last month, India swiftly pivoted to considering comprehensive AI laws by mid-2024. MeitY published an advisory requesting firms to seek government approval before publicly releasing any AI tools that are under trial or deemed to be unreliable.

This balanced approach aims to foster innovation while addressing potential risks associated with AI deployment.

AI’s Potential and Challenges

AI holds immense potential to commoditize human intelligence, including analysis, decision-making, and content creation.

However, its widespread adoption also brings significant challenges, particularly in terms of job displacement and ethical considerations.

Job Displacement Risks

According to the report, the banking industry will be the hardest hit by AI-led job displacement, with 54 percent of roles at risk.

Other high-risk sectors for job displacement include insurance (48 percent), energy (43 percent), and capital markets (40 percent).

While AI can automate routine tasks and enhance efficiency, it also raises concerns about the future of work and the need for reskilling and upskilling the workforce.

Ethical Considerations

The deployment of AI in banking and other industries necessitates careful consideration of ethical issues. These include ensuring transparency in AI decision-making processes, protecting customer privacy, and preventing biases in AI algorithms.

Addressing these ethical concerns is crucial to building trust in AI technologies and ensuring their responsible use.

AI’s Role in Shaping the Future of Banking

As AI continues to evolve, its role in the banking sector is expected to expand, offering new opportunities for growth and innovation. Here are some key areas where AI is poised to make a significant impact:

Customer Experience Enhancement

AI-powered chatbots and virtual assistants are revolutionizing customer service in banking. These tools can handle routine inquiries, provide personalized recommendations, and offer 24/7 support, enhancing the overall customer experience.

Risk Management and Compliance

AI can streamline risk management and compliance processes by analyzing vast amounts of data to identify potential risks and ensure regulatory compliance.

This can help banks avoid costly penalties and enhance their reputation.

Personalized Financial Services

AI can analyze customer data to offer personalized financial products and services tailored to individual needs and preferences.

This level of personalization can help banks build stronger relationships with their customers and increase customer loyalty.

Operational Efficiency

By automating routine tasks and optimizing processes, AI can significantly enhance operational efficiency in banking.

This can lead to cost savings, improved productivity, and a more agile organization capable of adapting to changing market conditions.

Artificial intelligence is set to revolutionize the global banking sector, offering unprecedented opportunities for growth, innovation, and efficiency.

By boosting the banking sector’s profit pool by $170 billion by 2028, AI has the potential to drive significant economic benefits.

However, this transformation also brings challenges, including job displacement and ethical considerations, which must be addressed to ensure the responsible and sustainable adoption of AI.

As regulatory frameworks evolve and AI technologies continue to advance, the banking sector must navigate these changes carefully.

By embracing AI’s potential while addressing its risks, banks can position themselves for success in the digital age.

The future of banking lies in the effective integration of AI, enabling a new era of efficiency, innovation, and profitability.

ALSO READ: What Is Data Science?